5 Reasons Your Stock Investments Isn't Working

Last updated: Jun 29, 2022

Investing isn’t easy. At least not at the beginning. This is why so many people lose money in the stock market. Regardless of how hard they work.

Here I’ll show you a list of common problems and easy solutions that work. Tactics that will make you money in the long term.

Long-Term Stocks

Too little time has passed and you have to wait it out. Stocks go down about 24% of the time.

Meaning even if it’s in your favor you will still see stocks go down. And you have to do nothing other than to hold it.

Every 3.6 years the markets go down on average 36% while about every 2 years stocks go down 10% or more.

Meaning you can also buy at a bad time even if you have done everything.

Proper Stock Research

You don’t need to do much stock research but grasping the basics is crucial for doing better stock picks.

So learning some basic key ratios is a very good start. But you have to remember to google the specific branch of company-specific key ratios.

Since some are useless in other companies. For example, using the P/E ratio in an investment or real estate company will give you a false idea of the company.

Since they calculate the estimated valuation difference of their underlying assets as profits.

Also, companies try to make their ratios look better to attract investors. So if it looks too good to be true it can happen because it is.

Comparing the ratios of other companies in the same branch since then we can see who is “better”

And comparing them over a longer period to see if it's not occurring once.

A company has 5 basic parts of a business. Making money, saving, investing, owning, and debt.

Revenue - This is making money, think of it like a company's salary.

Earnings - This is what’s left out after all bills are paid. Think of this as a company's savings. So what’s left over.

Investments - Like we try now to buy stocks companies do the same. But they don’t invest in stocks but in all kinds of types of machinery and all else that can generate a profit.

Assets - Things a company owns like real estate, stocks, money, or even immaterial stuff like brand name and intellectual property.

Debt - For many companies, a bit of debt is good since they make more money than interest payments.

Key Ratios:

- P/E

- - Stock Price / Earnings

- P/S

- - Stock Price / Sales or revenue

- P/B

- Stock Price / Book value - The book value is all assets the company owns. So all tangible and intangible assets

- D/E

- Liabilities / Shareholders Equity - Shareholders Equity is all assets and liabilities combined.

These are the basic ones. There are hundreds if not thousands of more key ratios.

Read More: Basics of Fundamental Analysis

Stock Investment Strategies

Many people lack a strategy, can't stick to it, or don't have such a good strategy.

There are many different types of strategies but many do have similar traits to one another.

Here are some strategies used in almost every kind of investing:

Diversification - A risk management strategy that means spreading your eggs to more than one basket. So if you drop the one basket you don't break all your eggs.

Meaning doesn't own one stock. Especially if you don't know much about the company.

Diversification is protection against ignorance

- Warren Buffet

There is no set of rules on how many stocks you should hold since it depends on how well you know your companies.

But to have at least some is what all investors in the world are doing.

Mixing up several shit companies. And then calling them safer because of diversification is also a bad idea.

Read more: 6 Stock Valuation Strategies

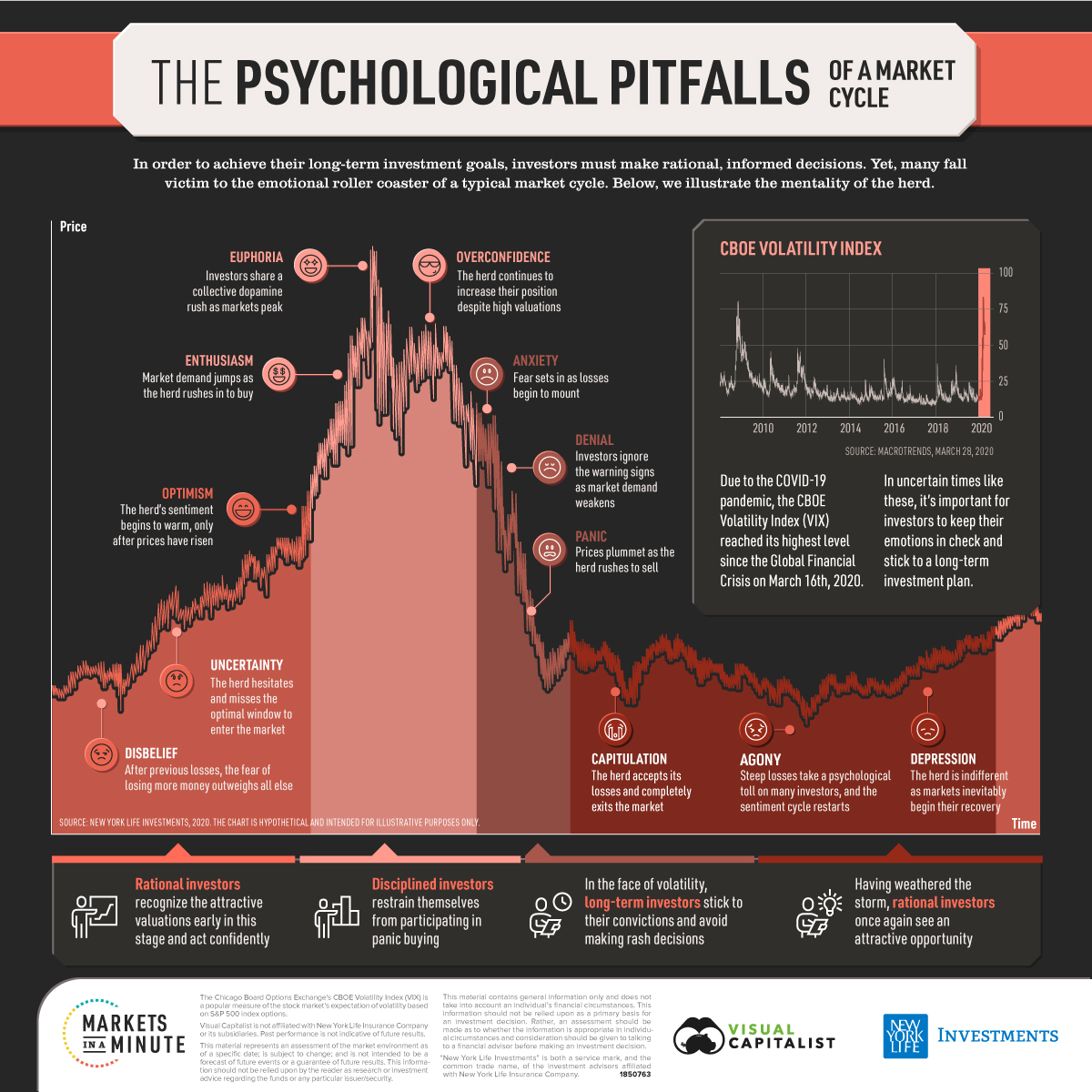

Market Psychology

The good and bad things about us humans are the emotions we have. But they most likely do not belong to the stock market.

Since we bought stock we own a piece of that company. And what has changed when the prices decline?

Only that the market says they will pay that price for your company today. Imagine if you stand in front of the business you bought.

And someone comes and says that they will buy it for 30% less than you bought it for.

Would you sell it?

If the answer is yes then that means you know too little about the company you bought. And you have no idea of its value rather than if someone comes and tells you.

So know your business you bought so you know if the price someone will pay you for it is good.

Buying and selling because someone tells you is like the following someone off a cliff.

There are many other Investing emotional factors in this business.

Many people sell if they gain +10% and if it goes down -by 30% they also sell. Looking at this we can see how bad this is.

So keep in mind our psychological factors. And try to not make decisions on them is a good practice.

If you're stressed out about buying/selling right away. You are making decisions based on emotions.

Writing down when it's time to buy and sell can make you better by following your strategy.

And it still hurts when I buy a stock and it goes down -by 30% in a few days.

And when I sell it, it goes up 30% more. But guess what? I'm still making money no matter what. As opposed to losing money.

Buy And Hold

Assuming you have a good strategy and okay stocks you can hold them since stock in time mostly goes up.

There are also buying and selling fees that can eat up your stock profits.

Buy and hold does indeed work, even if you're a beginner.

And it feels bad because you're gone down. But in time you probably will be alright.

If you have done at least some research. like looking at the financial stock ratios, and comparing them to that of the same branch. And assuming the ratios you're looking at are valid for that specific company.

And applying some diversification. You can hold them till they get sold to their true value or are expensive.

Remember to also buy at least some in an index fund so you can compare yourself vs the market.

And see if you should buy more stocks or go the buy and hold way with buying ETFs

Conclusion

In very short, do nothing if you have done the research.

Lack of basic research and reading forum posts are not enough. Doing some fundamental research like comparing P/E, P/S, and P/B to other companies and in other periods can be enough. At least compared to doing none.

Buying stocks that you would consider holding for the long term. That means stable companies that most likely will continue to perform over the long.

You don't have to hold them for the long-term if it goes up too much but at least you can't lose money over the long.

Applying some strategies like at least diversification for risk management.

Try to not do things based on your emotions, this is easier said than done. But having basic knowledge of some common Investing emotions can be good.

And not doing any financial decisions with emotions.